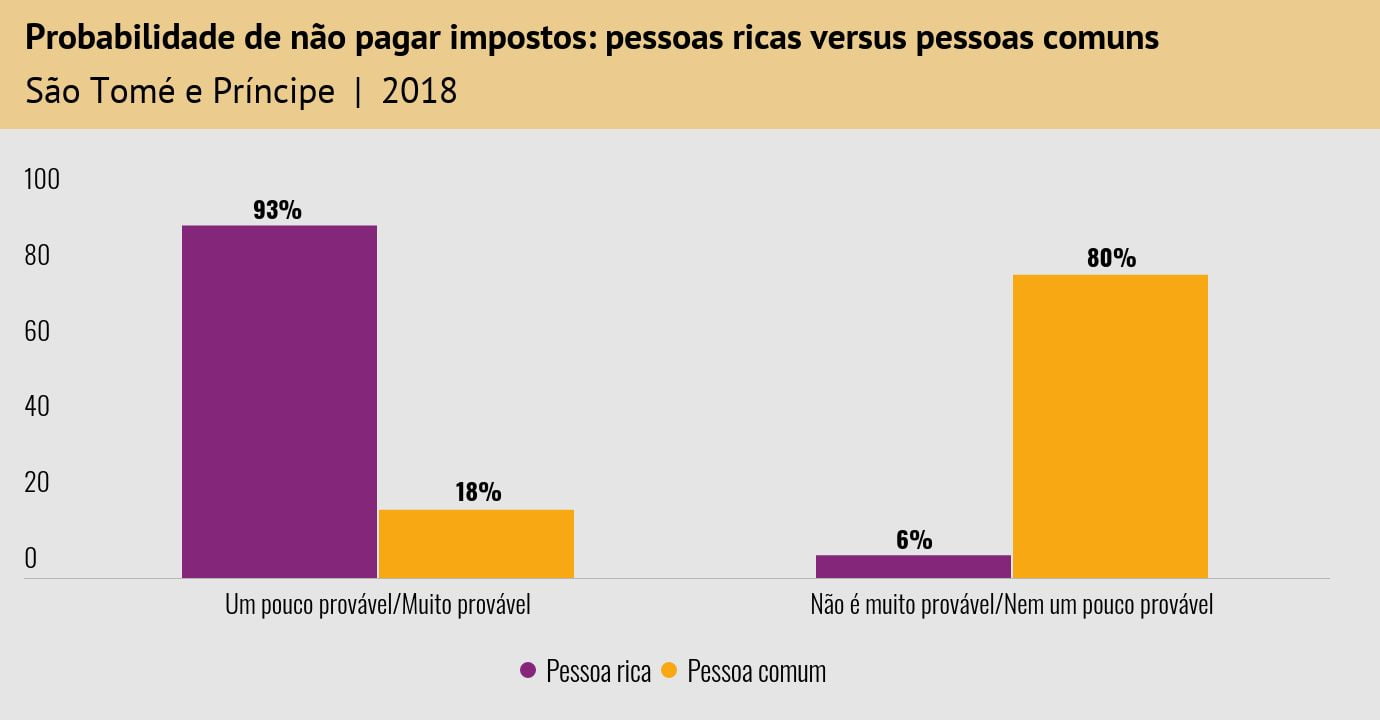

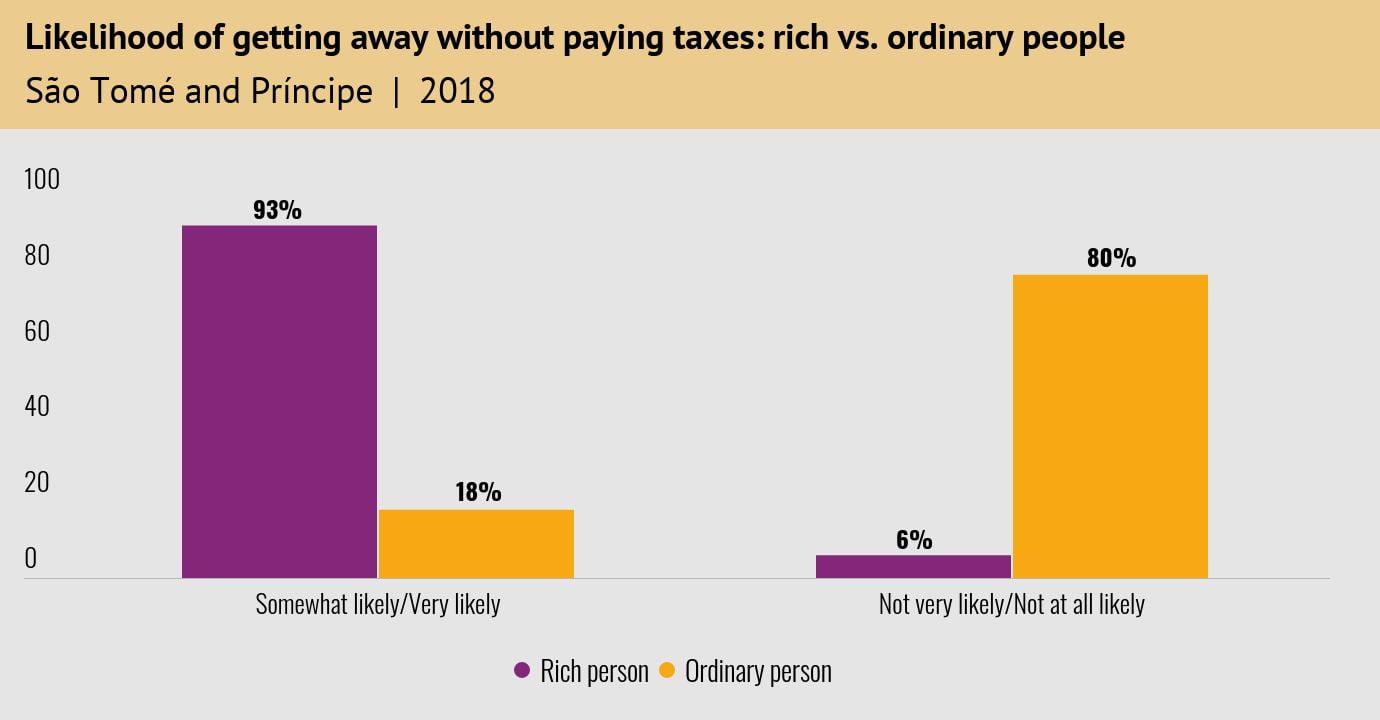

- In Afrobarometer surveys in 2015 and 2018, São Toméans overwhelmingly endorsed the legitimacy and importance of taxation.

- But at the same time, only a quarter (26%) of São Toméans said they trust tax officials, and a majority (54%) believe that at least “some” tax officials are corrupt

- More than half of citizens see non-payment of taxes as “wrong but understandable” (39%) or not wrong at all (16%).

- About six in 10 São Toméans (61%) find it “difficult” or “very difficult” to access information on which taxes or fees to pay to the government.

While tax revenues are a critical part of financing government services, many developing countries face obstacles in implementing effective and efficient tax systems (Tanzi & Zee, 2000). Direct taxes, such as personal income taxes, are particularly difficult to administer as they require complex processes and structures to identify taxpayers and facilitate and enforce compliance (Kangave, 2005). Given these difficulties, many developing countries rely heavily on consumption taxes that cannot be evaded even by those in the informal sector. One of the most popular consumption taxes is value added taxation (VAT).

In São Tomé and Príncipe, domestic revenue collection is constrained by a small taxpayer base (Nisreen, 2009). In recent negotiations with the International Monetary Fund, the government proposed the introduction of a VAT to improve domestic revenue mobilization (International Monetary Fund, 2019).

Recent Afrobarometer surveys show that most São Toméans see taxation as a key tool for development and a civic duty regardless of whether one is satisfied with government services. However, there is a widespread perception of unequal application of tax regulations and high levels of perceived corruption in the tax department.